The 2021 budget was announced last night (11th of May 2021) and there was a lot that was spoken about. Please keep in mind that the proposed budget is not legislation and must be discussed in parliament and then needs to be passed through the senate.

Below we have compiled a summary of the budget, along with the full budget summary at the very end of the article.

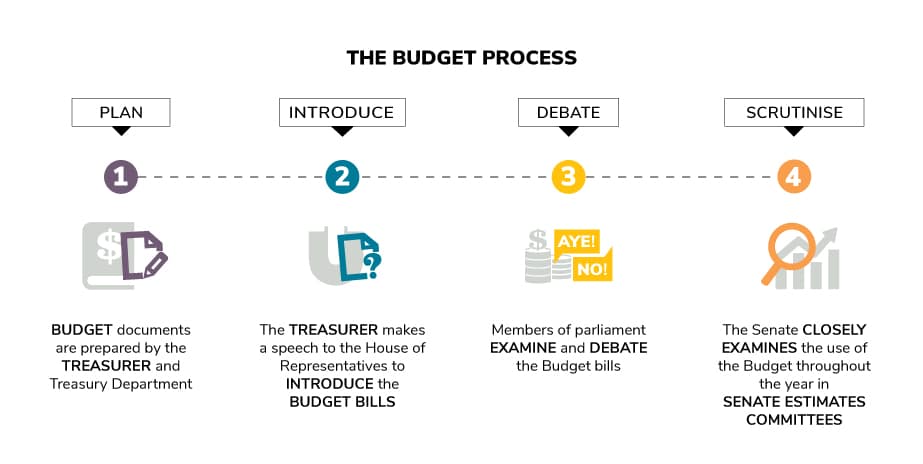

The Budget Process

The diagram below shows the process that is taken.

Image courtesy of Parliamentary Education Office (peo.gov.au)

Description

This diagram illustrates the development and operation of the Budget. Budget documents are prepared by the Treasurer and introduced through a speech to the House of Representatives. Members of parliament examine the Budget bills. The Senate examines the use of the Budget throughout the year in Senate estimates committees.

Summary of Tax Changes

Some of the areas that we saw that would affect our clients and were points of interest were as follows:

Extension of the Tax Supports for Business Incentives

Temporary full expensing and temporary loss carry back has been continued.

Temporary Full Expensing allows eligible businesses to deduct the full cost of eligible depreciable assets, rather then having them depreciate over time.

Temporary Loss Carry-Back will be extended to cover the 2022-23 income year, which means that businesses making a loss will be able to be offset against previous profits as far back as 2018-19.

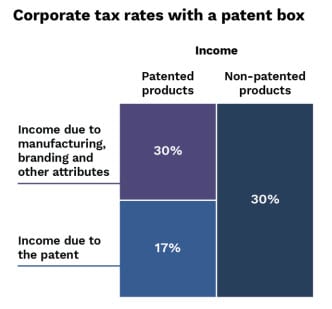

Patent Box – Reduced Tax Rates for Income From Medical and Biotech Patents

Following the lead of UK and France, the introduction of the Patent Box, will mean that taxable income derived from Australian medical and biotech patents will be taxed at a rate of 17% instead of the standard company tax rates of 25 or 30%. This will however, only apply to patents which have been applied for after the budget.

This is to encourage R&D in Australia and to keep patents here.

Increased Rights for Small Business to Pause Collection of Disputed ATO Debt

An administrative appeals tribunal would be established which will allow small businesses to pause debt collection whilst it is in dispute. This should make lives much easier for many people and is a great outcome, should it come to fruition.

The government will make is easier to offer employee share schemes (ESS) by removing red tape and cessation of employment taxing point for tax-deferred ESS. This is to encourage high quality talent from locally and overseas.

Digital Games Tax Offset

In an attempt to help take Australia further into the global games development market, the government would like to offer a 30 per cent refundable tax offset for qualifying Australian games expenditure. Qualification requirements apply.

Brewers and Distillery Excise Refund Scheme Cap

The government are giving tax relief to breweries and distilleries by receiving a full remission(previously 60%) on any excise the pay on the alcohol they produce up to a cap of $350,000 which was previously $100,000.

Changes to Residency Rules

The test will be simplified to make it that a person that is physically present in Australia for 183 or more days will be considered an Australian resident for tax purposes. This will reduce the need for heavily priced compliance costs which are currently required.

Corporate residency rules would be expanded to include amendments to the trust and corporate limited partnerships.

Digital Economy Depreciation Self Assessment of Intangible Assets

For patents, registered designs, copyrights, in-house software, licenses and telecommunications site access rights, tax payers will be able to give assets shorter effective life

Self-education Expenses

The $250 threshold is to be removed which will simplify self education expenses in a positive way.

Removal of the $450 per month superannuation minimum

The budget made mention of the removal of the $450 per month superannuation threshold, which will increase superannuation savings.

Further Resources

Tax Fact Sheet – budget.gov.au