Business Lockdown Grant

The application process is now available to get the $1000 or $3000 SA State Government Grants. This is for businesses.

The eligibility questions are as follows:

To be eligible for the $3000 employing grant, as of 12:01am Tuesday 20 July 2021 your business must:

- Have a valid and active Australian business number (ABN) and were carrying on the operation of a business in South Australia

- Employ people in South Australia(to be considered an employee staff must be under the control of the business, and have income tax and superannuation paid by the employer)

- Have an annual turnover of more than $75,000 (excluding GST) in either 2019-20 or 2020-21

- Have total Australian payroll of less than $10 million in 2019-20

- Have experienced at least a 30 per cent reduction in turnover in the week defined as Tuesday 20 July 2021 – Monday 26 July 2021 (inclusive) (compared to the prior 7-day period) due to restricted trading conditions

- Not be engaged in illegal activity

To be eligible for the $1000 non-employing grant, you need to meet all of the above, without the employing people part.

The first step is to register here

You may need to provide evidence of the impact that the lockdown has had on the business.

Examples of turnover impact evidence:

- Turnover comparison data for the week prior to the assessment period

- Emails or texts to or from clients or suppliers detailing cancelled orders or appointments

- Receipts for refunds provided

- Invoices or delivery dockets

- Appointment/scheduling platform, demonstrating cancelled appointments or bookings

- Screenshots of cancelled events

The process is quick and easy though, so if you are eligible, go ahead and apply.

Disaster Grant

To apply for the federal government support you will need to login to your mygov account and follow the link on the page. This is primarily for employees.

To get this payment you must meet the following:

- you’re at least 17 years old

- you’re an Australian resident or a holder of a visa class permitted to work in Australia

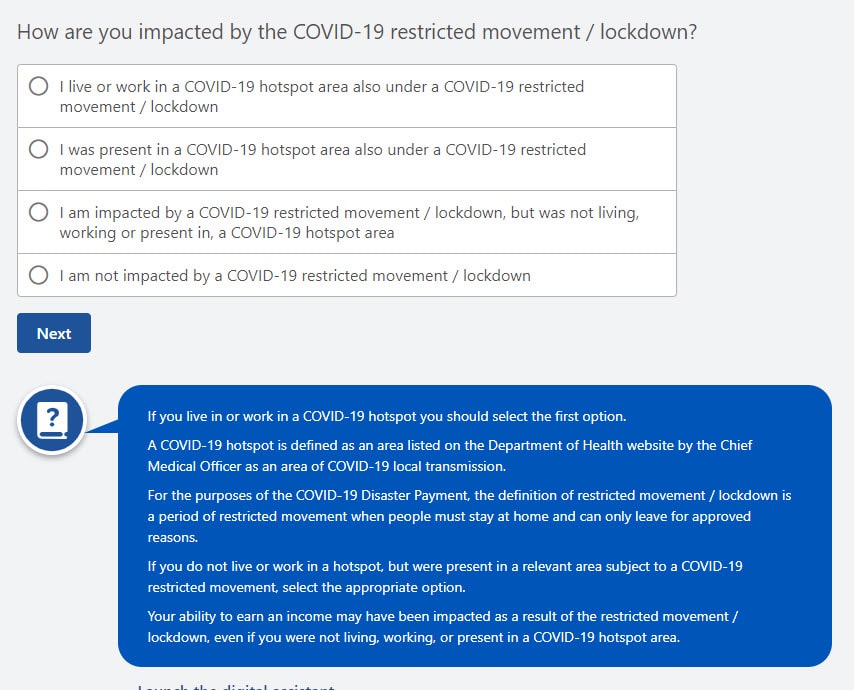

- you reside, work in, or were present in, a COVID-19 hotspot area that has also been placed under restricted movement / lockdown, or you reside or work within a state that has a declared COVID-19 hotspot area

- you are not able to work and therefore unable to earn any income as a result of a restricted movement / lockdown

- not receiving an income support payment (including if on nil rate) or a Pandemic Leave Disaster Payment for a period you claim this payment for

- exhausted all employer paid pandemic-related leave entitlements.

This will be available tomorrow to apply for.

Well Done!

Well done to the magnificent effort from South Australian’s and SA Health to control the spread of the Covid-19 virus during this brief lockdown.