Here at Ace Business we are continually refining our processes to improve our efficiencies and to also better meet our clients needs.

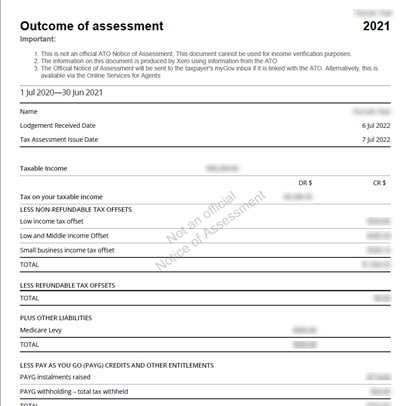

We are making some minor adjustments to our process for sending Outcome of assessments after the ATO has processed them. We will send out an Outcome of assessment using data from the ATO generated inside of our software – Xero.

This will not be the official ATO document “Notice of assessment”. This is simply a reference to show you the outcome of the ATO’s decision after we have lodged your tax return. It will not have a document reference, and cannot be used for income verification purposes. For this you would need the official Notice Of Assessment, which is available via your myGov Inbox, or if you are unable to find it in myGov, then please let us know so we can follow it up for you – contact [email protected] or our office phone on (08)8281 3686.

You will receive an email which will have the Outcome Of Assessment attached to it in pdf format. It will also be password protected for higher security. The password will be your date of birth in the format dd-Mon-YYYY (2 digit for the day, dash, 3 letter shorthand of month, starting with a capital letter, dash, then four digit year) eg 01-Jan-1950 – please note the capital letter for the month.

The official Notice of Assessment will be sent to the taxpayer’s myGov inbox if it is linked to the ATO. Alternatively we can supply this to you upon request. We were previously sending through Notice of assessments that had the tax file number redacted, but in an assessment of our processes we have found that this will be more secure and efficient for our clients.

We are working at new processes to allow us to assist our clients much more efficiently.

Troubleshooting

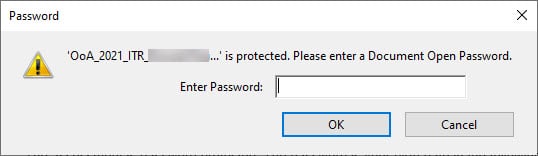

In this early stage we have had some reports of issues opening the pdf when it arrives so we are putting together a troubleshooting guide.

- Password not accepted – we found in some tests, that some software has issues opening password protected pdf’s in particular if they aren’t the “premium” version. Another issue that has been found is that some people haven’t capitalised the letter. Eg if your birthday is 1st February 1990, it would be 01-Feb-1990 – you must capitalise the F or it will fail. Password’s in nearly all software are case sensitive.

- Alternative method to open – From the email save the document to your computer. Find the file and while holding down the shift key, right click, and select “open with…” and choose chrome. This will then allow you to open the outcome of assessment inside of chrome, which we’ve had 100% success rate in opening these documents, along with adobe acrobat.

FAQ

Why can’t we just send the original pdf from the ATO via email?

It is in our rules from accounting bodies that we must not do this unless it is secured as it contains the tax file number. We take security very seriously so we make sure that tax file numbers are not sent to comply with this.

What if I need a document reference ID to discuss matters with the ATO?

You have 2 options here:

1. The first is to log into your mygov account (not mysagov or mygovid), and if your ATO account is linked then you can download the original document here, which includes the document id. In most cases this will be the easiest and fastest way to get the document.

2. The second method, is to email our admin at [email protected] and request your document. Our friendly admin staff will then need to go into the tax portal, download the document, redact all instances of the tax file number and email it through. This method can usually be done within 3 working days.

Why are you doing this now?

At Ace Business we are always looking to find better ways to service our customers.

We are trialing this new process with the goal of making the delivery of the outcome of assessments faster and this innovative new method has a much better turnaround time than previously for you.