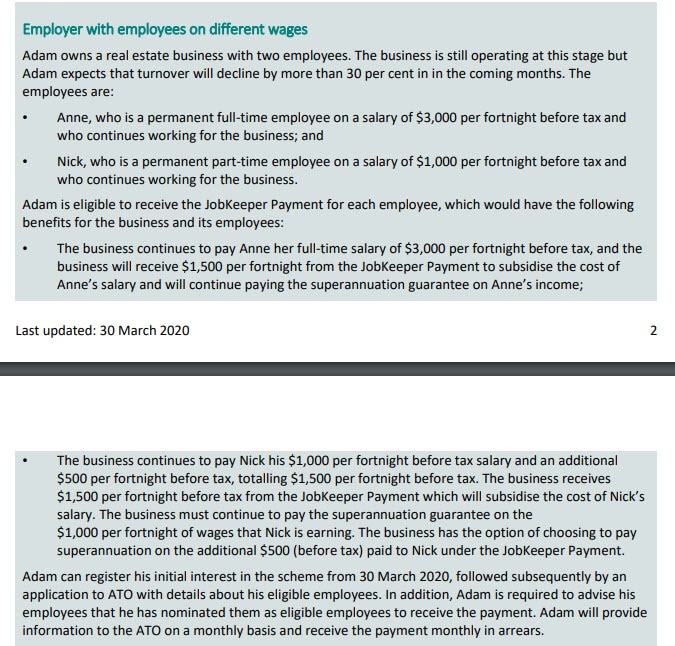

Since the announcement of the JobKeeper payment last week, we read through the fact sheet regarding the payments available for an employer to pass on payments to their employees. There is an example in the fact sheet that showed someone called Adam that received payments to give to his staff, whilst Adam’s business is crippled by the Covid-19 crisis. So this leads to the following question:

What about Adam?

How is Adam meant to survive, if his staff are potentially receiving a JobKeeper payment when he isn’t receiving support for his own living expenses. How is Adam meant to ensure that his company will continue to operate when he hasn’t got the income coming in the door? Here is the example given:

JobKeeper for Companies and Trusts

Although companies and trusts were not mentioned in the original details that were circulated, we have found the details related to companies and trusts on this page.

In summary the part that is relevant to Partnerships, Companies and Trusts:

You may be eligible to receive the JobKeeper Payment if your turnover has been reduced because of the coronavirus. Following registration by the eligible business, the Government will provide $1,500 per fortnight per eligible employee for a maximum of 6 months.

The JobKeeper Payment is available to eligible employers, businesses including companies, partnerships, trusts and sole traders, not-for-profits and charities.

The intent of the JobKeeper Payment is to enable any eligible self-employed person get a wage subsidy regardless of what business structure they use, where:

- the partners in a partnership only receive a share of profits – one partner can be nominated to receive it

- directors of a company only receive dividends – one director can be nominated to receive it

- beneficiaries of a trust only receive distributions – one individual beneficiary (i.e. not a corporate beneficiary) can be nominated to receive it

Summary

So in summary, we are happy to say that the government has thought of Adam, and he will also receive the JobKeeper payment if he meets the eligibility requirements.

Please note that each individual circumstance is different and you should seek professional advice based on your circumstances.

Bec Purczel

Principle Accountant

Bec has a wide range of experience in many areas of accounting, and has a deep focus on assisting clients with personalised accounting services that are designed to suit their exact needs.